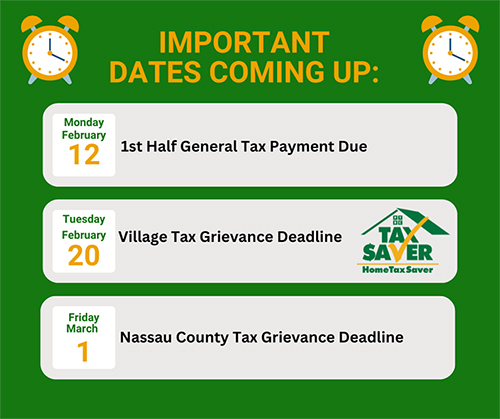

Key Property Tax Dates for Long Island Homeowners in Early 2024

Property taxes are a significant aspect of homeownership that can impact your financial planning and budgeting. For Long Island residents, staying ahead of property tax payments and grievance deadlines is crucial to managing your property effectively and ensuring you're not overpaying. Here are the important upcoming dates for property taxes on Long Island that you should mark in your calendar:

February 12, 2024: 1st Half General Tax Payment Due

The first half of the 2024 General Tax payments are due to the Receiver of Taxes. This is a key date for homeowners as it marks the deadline for the initial payment of your property taxes for the year. To avoid late fees and penalties, ensure that your payment is prepared and submitted by this date. You can make payments online, by mail, or in person at your local tax office. Check your town's official website for specific payment options and instructions.

February 20, 2024: Village Tax Grievance Deadline

For most villages on Long Island, February 20, 2024, is the deadline to file a grievance against your 2024/25 village taxes. If you believe that your property has been overassessed, filing a tax grievance could lead to a reduction in your tax bill. The grievance process allows you to challenge the assessment and potentially lower your future tax liabilities.

March 1, 2024: Nassau County Tax Grievance Deadline

The deadline to file a grievance against your 2025/26 Nassau County property tax assessment is March 1, 2024. This is an opportunity for Nassau County homeowners to challenge their property's assessed value, which is a direct factor in determining your property taxes. Filing a Nassau County tax grievance could result in significant savings if your property has been overassessed. Don’t miss the March 1st deadline.

For Long Island homeowners, keeping up with property tax payments and deadlines is essential for financial planning and management. By staying informed and proactive, you can ensure that you're paying no more than your fair share in property taxes.

Contact P.T.R.C., Inc. for help filing a grievance

Return